How to analyze the volume of trading in the market in the cryptocurrenia

The cryptocurrency world has seen a significant increase in business activities over the past few years, with many new users entering the market every day. While some perceive this growth as a sign of market potential, others perceive it as a warning sign. One of the key metria, which can give an overview of the health and direction of cryptomena, is the volume of trading.

What is the volume of trading?

The volume of trading applies to the total amount of the cryptomena traded during the particular period. It represents the number of coins or tokens exchanged for specific exchange such as bitcoin (BTC) to Coinbase or Ethereum (ETH) to Binance. The volume of trading is an important indicator of market activity and can be influenced by various factors, including messages, sentiment and prices.

Why analyze trading volume?

Analysis of trading volume can provide several advantages:

1

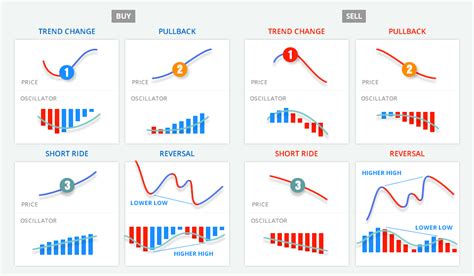

- Movement of prices : The volume of trading can help identify trends in the price movement of the cryptocurrency. A high volume of shopping activity can increase prices higher, while low volume may indicate resistance or decrease.

3

Market volatility : Low trading volumes may indicate market volatility, as fewer buyers and sellers participate in the market.

- Prices predictions : Analysis of trading volume can also help predict future pricing movements by identifying patterns and trends.

How to analyze trading volume

To analyze the volume of trading for market knowledge, follow the following steps:

- Select a cryptocurrency : Select a cryptocurrency you are familiar with or you have access to historical data.

- Explore the market : Stay in the current state of news, trends and developments that may affect the volume of trading.

3

Use platforms for trading with data platforms : Use online platforms such as CoinmarketCap, Cryptocompare or Binance’s API to access historic business data, including volume.

- Identify trends : Look for trading volume patterns, for example:

* High trading volume around major events (eg new list notifications)

* Low trading volume during consolidation periods

* Increased activity on specific exchanges

- Analyze trading volume over time : study the trend of trading volume over a longer period to identify any changes or changes.

Tools and Resources

Use the following tools and resources to increase the efficiency of the trading volume analysis:

1

- API exchanges : Access to historical data through API exchange interfaces, such as API Binance or Coinbase Developer Portal.

- Data visualization tools : Use tools such as TradingView or Etoro to visualize the volume of trading over time.

- Cryptocurrency news : Stay informed about news and trends on the market using renowned sources such as Coindesk, The Block or Coindesk.

Analysis of an example

Suppose you are interested in analyzing the business volume of bitcoin (BTC) to Coinbase during a particular period:

- Date: 1 March – 31 March

- Volume of trading:

+ Daily average: 10,000 BTC per day

+ Total volume per month: 200 000 BTC

+ Highest daily volume: 15,000 BTC (March 17)

+ Lowest daily volume: 5,000 BTC (15 March)

Based on this analysis, you can conclude:

- A strong sentiment on the market is present during this period, with a high volume of trading indicating the confidence of buyers in the currency value.

- Price movement suggests that prices are rising because traders are actively buying and holding bitcoins.

- The market volatility is mild, with a certain degree of price fluctuations.