The Relationship between Economic Indicators and Cryptocurrency Markets

Cryptocurrency Markets have experienced significant fluctuations over the years, driven by a complex interplay of economic indicators. While some analysts attribute the volatility to market sentiment, Others argue that underlying economic trends are more crucial to understanding cryptocurrency price movements. In this article, we’ll delve into the relationship between economic indicators and their impact on cryptocurrency markets.

What are economic indicators?

Economic Indicators refer to Statistical Data Used to Measure Economic Activity, Inflation, and Growth. These indicators Help Policymakers, Analysts, and Investors Gauge A Country’s Overall Health and Direction. Common Economic Indicators include:

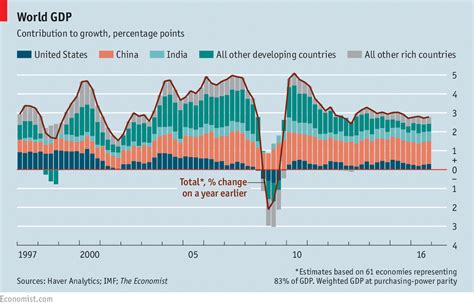

- GDP (Gross Domestic Product)

- Inflation rate

- UNEMPOYMENT RATE

- Interest rates

- Exchange rates

How Economic Indicators Affect Cryptocurrency Markets

Cryptocurrencies, Such as Bitcoin, Ethereum, and Others, Are Heavily Influenced by the Broader Global Economy. When economic indicators have a significant impact on cryptocurrency markets, it’s orte they live Reflect underlying trends that affect the underlying asset class.

- GDP Growth : Strong GDP Growth is a key indicator of a country’s economic health, which can drive up demand for cryptocurrencies like bitcoin. As economies grow, so do the prices of digital assets.

- Inflation : High Inflation Rates Can Lead to Increased Interest Rates and a Decrease in Cryptocurrency Prices. Conversely, deflationary pressures can result in Higher Prices.

- UNEMPLOYMENT RATE : Low unempleoyent rates are ofes associated with low inflation and rising asset prices, as they indicate economic expansion.

- Interest Rates : Changes in Central Bank Monetary Policy (E.G., Interest Rate Hikes) Can Impact Cryptocurrency Prices by Affecting the Cost of Borrowing for Investors.

Examples: How Economic Indicators Impact Cryptocurrency Markets

- 2017’s Bitcoin Bull Run

: As the US Economy Slowed Down and Inflation Rose, Cryptocurrencies Like Bitcoin Experienced a Significant Surge in Price.

- 2020s COVID-19 Pandemic : Duration the Pandemic, Central Banks Worldwide Implemented Unconventional Monetary Policies to Stabilize Economies. This LED to a Sharp Increase in Cryptocurrency Prices As Investors Sought Safe-Haven Assets.

- 2018’s US-China Trade War : The Escalating Trade Tensions between the US and China had a significant Impact on Global Markets, Including Cryptocurrencies. Bitcoin and other altcoins SAW Increased Volatility Due to Market Uncertainty.

Caveats: Economic indicators are not the only factor in cryptocurrency markets

While Economic Indicators Play A Role in Shaping Cryptocurrency Markets, They’re not the only factor at play. Other influencing factors include:

- Regulatory Environment

: Changes in Government Regulations and Policies Can Significantly Impact Cryptocurrency Adoption and Prices.

- Supply and Demand Dynamics : The Balance Between Supply and Demand Determines The Price of Cryptocurrencies.

- Technological Advancements : Improvements in Blockchain Technology can lead to increased adoption, Driving Up Prices.

Conclusion

Economic Indicators are an essential component of understanding the relationship between cryptocurrency markets. While They Contribute to Market sentiment and Volatility, Underlying Trends and Factors Like Inflation, Unemployment, Interest Rates, Supply and Demand Dynamics Play A More Significant role in Shaping Cryptocurrency Prices. As cryptocurrencies continuous to evolve, it’s essential for investors to stay informed about thesis economic indicators and their impact on the market.

Recommendations

1.